History, Status and Capital Structure

The Bank was founded under the name of Devlet Sanayi ve İşçi Yatırım Bankası (State Industry and Laborer’s Investment Bank Ltd -DESİYAB) A.Ş.

With its strong foundations and stable structure, the Bank assumed an important mission in Türkiye’s progress towards its development targets. The foundations of the Development and Investment Bank of Türkiye (TKYB) were laid with DESİYAB, established in accordance with the Authorization Act No. 1877 and Statutory Decree No. 13 dated November 27, 1975 as an incorporated company and a development and investment bank subject to the provisions of private law to conduct all the activities of investment and development banking, including profit-sharing-based capital finance.

The Bank was renamed as Türkiye Kalkınma Bankası A.Ş. (Development Bank of Türkiye Ltd) and authorized to also finance other sectors than the industrial sector.

T.C. Turizm Bankası A.Ş. was transferred to the Development Bank of Türkiye with all of its asseting and liabilities.

New programs for priority development regions were undertaken.

The Bank’s Charter Act No. 4456 was enacted and entered into force.

The Bank started wholesale banking activities.

The Bank’s total asseting exceeded $1 billion.

The Bank continued its sustainable growth performance.

The Bank secured long-term resources at a record level.

As a result of the strong international relations that it has built over many years, the Bank secured nearly $840 million in long-term resources from five different international financial institutions.

The Bank’s financing support to the country’s development exceeded Turkish Lira 3 billion

The Bank’s strategic plan for the period 2015-2019 was approved.

The Development Bank of Türkiye decideds to increase its issued capital to Turkish lira 500 million

The Development Bank of Türkiye expanded its global collaboration network with new initiatives.

The Development Bank of Türkiye strengthened its pioneer position in the finance industry with its Carbon Disclosure Project report.

The Development Bank of Türkiye started providing loans under the €100 million CEB Apex facility.

The Development Bank of Türkiye secured $200 million in financing from the Islamic Development Bank.

The Bank was restructured and renamed as the Development and Investment Bank of Türkiye (TKYB).

Law No. 7147 on the Bank entered into force after having been published in the Official Gazette No. 30575 and dated October 24, 2018. As a result, the Bank’s name was changed to “Türkiye Kalkınma ve Yatırım Bankası A.Ş.”

Accomplishing a first in Türkiye, TKYB established the Asset Finance Fund.

On November 15, 2018, TKYB established the Asset Finance Fund. The Fund invested in Mortgage-Backed Securities with high-quality collateral in the portfolios of the industry’s leading banks and issued Asset-Backed Securities takingthese securities as collateral. On December 7, 2018, Asset-Backed Securities in the amount of Turkish lira 3.15 billion were issued. The method, implemented for the first time in Türkiye, provided banks with liquidity and investors with an investment opportunity with high-quality collateral.

TKYB became the first Bank in Türkiye to obtain the “Climate Friendly Institution” certificate.

In 2018, the Development and Investment Bank of Türkiye proves its dedication to achieve environmental, social and financial sustainability, to increase the awareness of the public and its stakeholders about combatting climate change and to set an example in the industry with its sustainability activities by being the first institution in all industries and the first bank to obtain the “Climate Friendly Institution” certificate.

TKYB secured a record $400 million loan from Industrial and Commercial Bank of China (ICBC) for its wholesale banking operations.

TKYB signed a €50-million loan agreement with the Black Sea Trade and Development Bank to finance SMEs.

With The Establishment of the second Asset Finance Fund, 1 Billion Turkish Liras were issued.

Development and Investment Bank of Türkiye moved its headquarters to Istanbul.

Türkiye Development Fund was established.

Development and Investment Bank of Türkiye became the founding signature of UNEP-FI responsible banking principles.

Regional Development Fund and Technology and Innovation Fund officially started to activities under the same roof of Türkiye Development Fund.

Attended Birleşik İpotek Finansmanı A.Ş. and JCR Avrasya Değerlendirme A.Ş.

Development and Investment Bank of Türkiye published the first sustainability report.

Türkiye's first social sukuk issued, which is the fund user of Development and Investment Bank of Türkiye.

Development and Investment Bank of Türkiye became the first institution in Türkiye to sign the operating principles for impact management under the leadership of the Global Impact Investing Network (GIIN).

Development Participation Venture Capital Investment Fund was established by Kalkınma Giriş Sermayesi Portföy Yönetimi A.Ş. and Development and Investment Bank of Türkiye Capital Fund was established by our Bank.

Development and Investment Bank of Türkiye published the first Integrated Report.

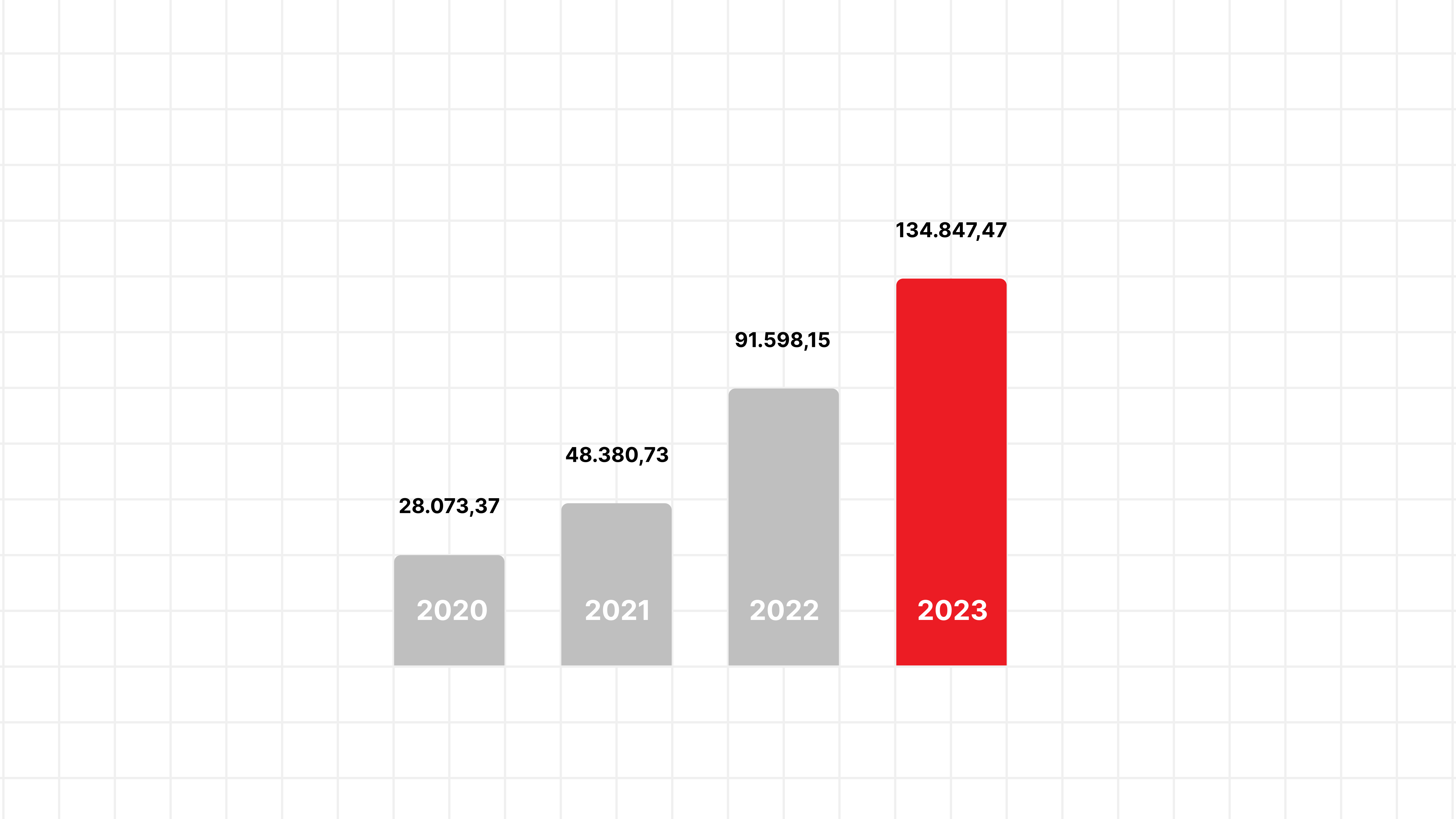

TKYB maintained its successful financial progress in 2023 and increased its total asseting by 47 percent to Turkish lira 134.8 billion.

Primary Indicators (Million TRY)

| December 2022 | December 2023 | Change (Value) | Change (%) | |

|---|---|---|---|---|

| Total asseting | 91.598,15 | 134.847,47 | 43.249,32 | 47,22 |

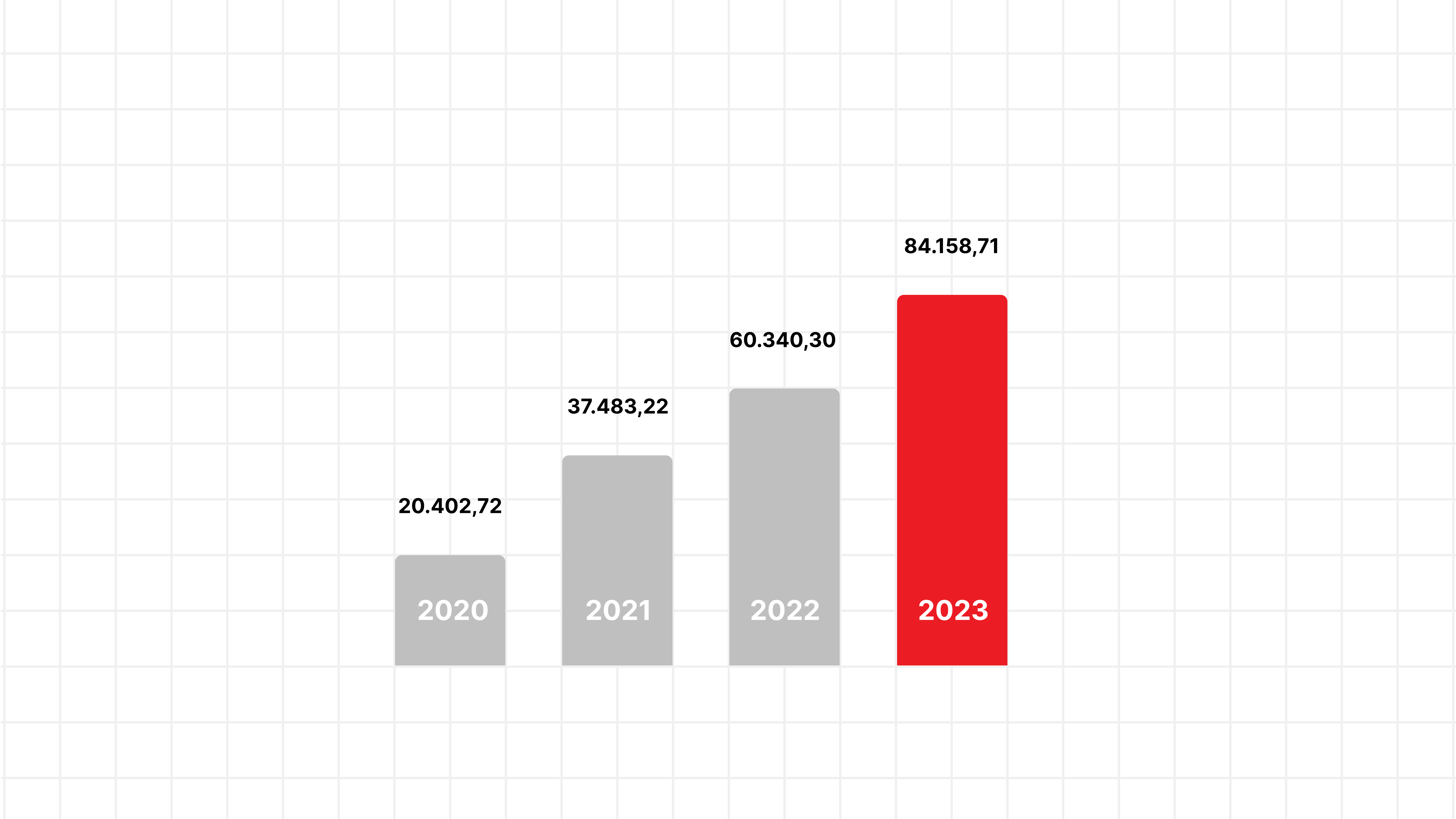

| Loans (Net) | 60.340,30 | 84.158,71 | 23.818,41 | 39,47 |

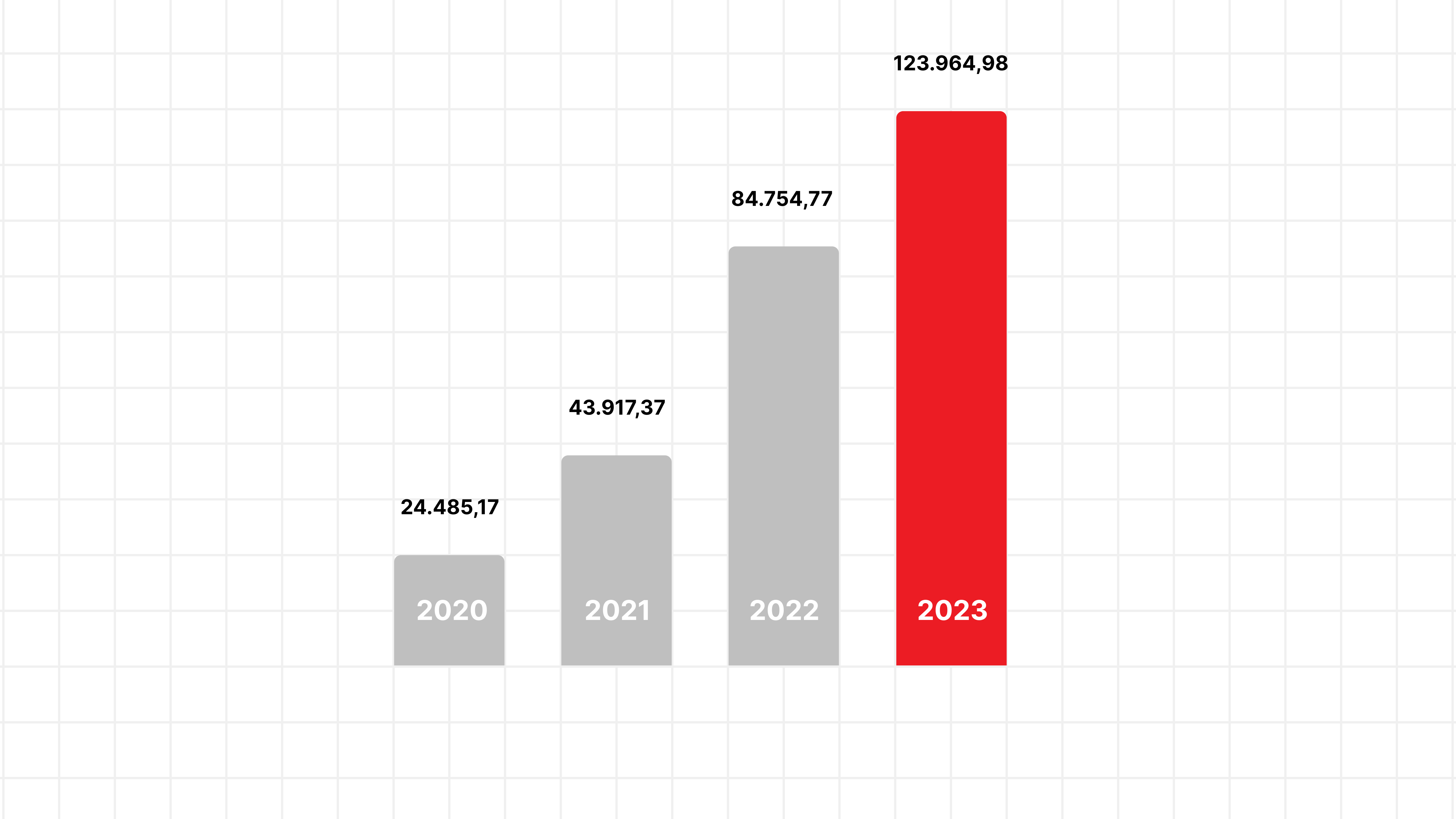

| Liabilities | 84.754,77 | 123.964,98 | 39.210,21 | 46,26 |

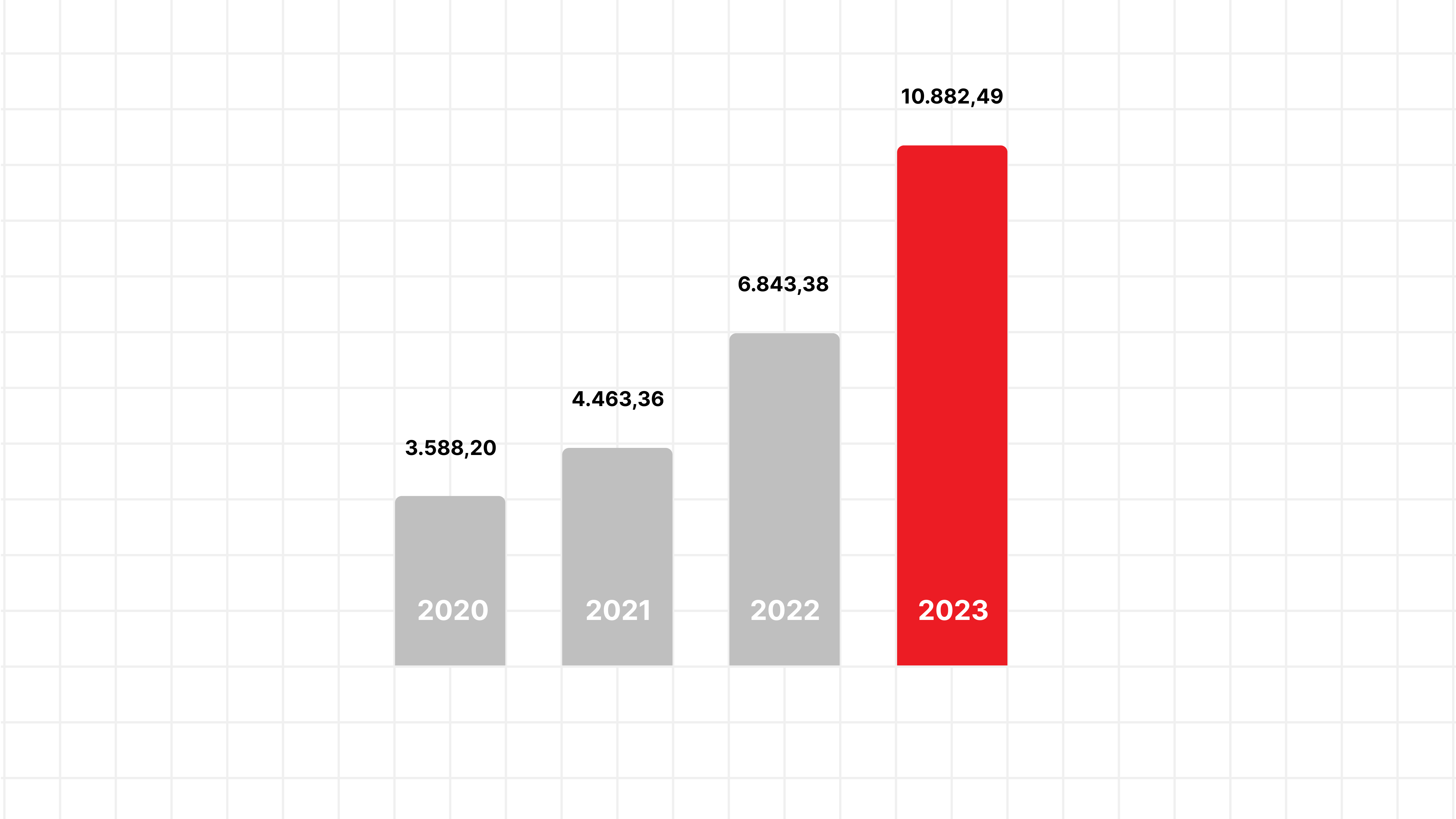

| Equity | 6.843,38 | 10.882,49 | 4.039,11 | 59,02 |

| Total Revenues | 8.664,64 | 23.078,92 | 14.414,28 | 166,36 |

| Total Expenses | 6.973,27 | 19.035,54 | 12.062,27 | 172,98 |

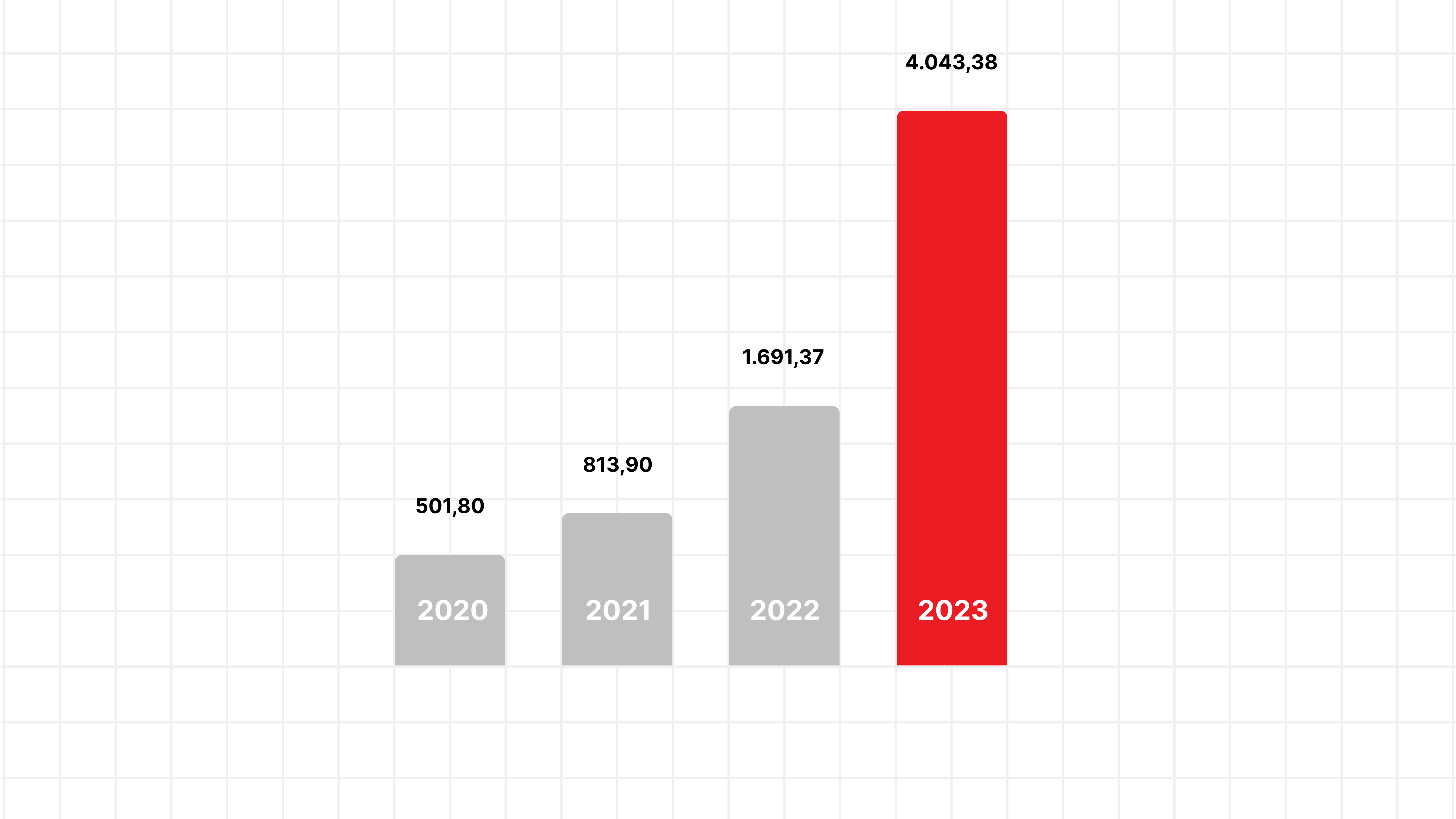

| Profit/Loss | 1.691,37 | 4.043,38 | 2.352,01 | 139,06 |

Primary Ratios (%)

| December 2022 | December 2023 | |

|---|---|---|

| Loans (Net)/Total asseting | 65,88 | 62,41 |

| Equity/Total asseting | 7,47 | 8,07 |

| Return on asseting | 2,39 | 3,57 |

| Return on Equity | 31,14 | 45,66 |

| Capital Adequacy Standard Ratio | 16,67 | 16,86 |

- Total asseting (Million TRY)

- Loans (Net) (Million TRY)

- Liabilities (Million TRY)

- Profit Loss (Million TRY)

- Equity (Million TRY)

Ownership Structure of TKYB(*)

| No. | Shareholder Name | Current Share Capital (TRY) | (%) |

|---|---|---|---|

| 1 | Republic of Türkiye Ministry of Treasury and Finance | 9.908.153.053,05 | 99,08 |

| 2 | Other (*) | 91.846.946,95 | 0,92 |

| Total | 10.000.000.000,00 | 100,00 |

(*)Includes all natural and legal persons, the majority shares of which are traded on Borsa Istanbul.

Ownership structure

Capital Increase

In accordance with the decision dated December 18, 2024 of the Development and Investment Bank of Türkiye Board of Directors to enhance placement capacity of the Development and Investment Bank of Türkiye and in compliance with Article 6 of the Articles of Association of the Bank, it was resolved to increase the Turkish lira 5.5 billion worth of issued capital of the Development and Investment Bank of Türkiye by Turkish lira 4.5 billion (at a 81,8 percent rate) to be compensated entirely in cash, to reach Turkish lira 10 billion in total within the limits of the registered capital ceiling worth Turkish lira 10 billion.